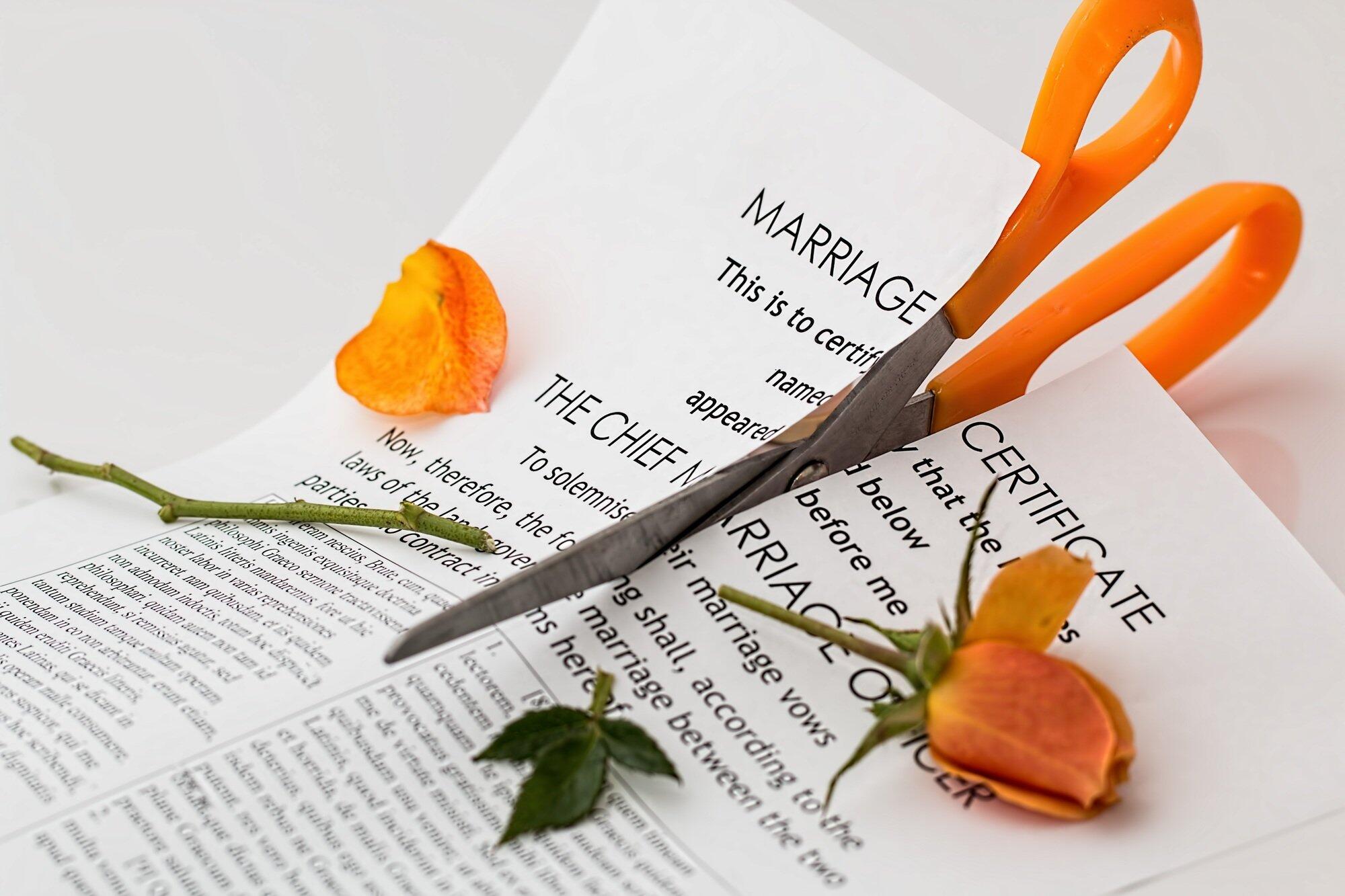

Separating from your spouse can be overwhelming, especially when it comes to money matters. A solid financial plan is crucial during this time. Creating a checklist for marriage separation helps you stay organized and prepared.

It ensures you don’t miss important details like shared assets, debts, or budgets. With the right steps, you can reduce stress and make the process smoother. In this guide, we’ll share simple tips to help you build a financial checklist for your separation.

Contents

Understand Your Financial Situation

Before making any decisions, review your current finances. This is a key part of pre-separation planning. Gather documents like bank statements, bills, and investment records.

Know your assets and debts. This includes property, savings, loans, and credit cards. Understanding your financial situation gives you a clear starting point.

Make a detailed list of what you own and owe as a couple. Include properties, cars, and joint accounts. Don’t forget debts like mortgages and credit card balances.

This is part of your divorce checklist essentials. Being thorough ensures fairness during the division process. It also prevents future arguments or confusion.

Separate Joint Accounts

It’s important to separate your joint accounts early in the process. Open new accounts in your name and update your banking details. This prevents confusion and protects your finances.

Inform your bank about the changes and close unnecessary joint accounts. Make sure both parties agree on how to divide the funds. This is a key step in taking control of your financial future.

Create a Budget for the Transition

Adjusting to one income can be challenging. Start by creating a budget for the separation period. Include living expenses, child care, and any new costs.

This separation process guide will help you prioritize your spending. Stick to the budget to avoid financial strain. A clear plan makes the transition smoother.

If you have children, shared parenting adds another financial layer. Include costs like school fees, medical expenses, and extracurricular activities. Decide how these costs will be shared.

This is an important part of marriage separation tips. It helps avoid conflicts over child-related expenses. Planning ahead makes co-parenting easier.

Seek Legal and Financial Advice

Consult a professional to guide you through the legal separation steps. A divorce lawyer can explain your rights and obligations. They also ensure that all financial matters are handled correctly.

Additionally, consider hiring a financial advisor. They can help with investments, tax issues, and future planning. Expert advice can save you money and stress.

Prepare for Long-Term Financial Independence

Think about your future financial needs. Update your will, insurance policies, and retirement plans. This ensures your finances reflect your new situation.

Start building an emergency fund if you don’t already have one. Save for unexpected costs during and after the separation. Planning for the future gives you peace of mind.

Stay Organized with a Checklist for Marriage Separation

A checklist for marriage separation is your key to staying organized during this challenging time. It helps you manage your finances, avoid mistakes, and plan for the future. By following the tips in this guide, you can create a strong financial plan.

Take the time to understand your income, expenses, and long-term needs. Stay focused and seek advice when needed. With a clear checklist for marriage separation, you can handle the process with confidence and less stress.

Did you find this article helpful? Visit more of our blogs.